Applying the power of human connection to personal finance.

Pivoting an early-stage personal finance product from a solo-use app to a MVP coaching platform.

Overview

Problem

Finding market product fit and channel market fit.

Clasp was a free consumer iOS app, focused on improving financial habits.

Despite running paid ad campaigns, adoption and engagement were low.

Solution

Clasp was reimagined as a platform connecting personal finance coaches and their audiences by:

Refining the iOS app as the Clasp Money Journal with a paid coaching add-on.

Enabling coaches to advise individuals or groups within the app.

Creating a financial coach marketplace as part of user acquisition.

Impact

Our MVP showed considerable promise and viability, based on user feedback and subsequent discussions with potential investors.

We continued development of the freemium app and initiatives to expand acquisition funnels.

Shortly after releasing the updated app, my co-founder stepped back for personal reasons, leading us to pause development. Although not what we aimed for, I learned about the value of rapid product iteration and the importance of flexibility.

Clasp's mission was to improve financial outcomes for young working women, a group often left out of the conversation.

Originally a passion project, I co-founded Clasp with a software engineer who also is a Chartered Financial Analyst.

Role & Responsibilities

As Design Co-founder, I led and executed all aspects of the product:

User research and product strategy

UX/UI and design system

Prototyping and concept testing

Branding and creative direction

Clasp Team

Tech Co-founder

Design Co-founder (me)

Part-time contractors:

iOS Engineer

Motion Design Specialist

Social Media Manager/Financial Coach

Timeline

9 months

Approach

Return to research

“It takes $50M to build a consumer brand from scratch,” a founding partner told us in our first investor advisory meeting.

Based on this feedback, we explored potential partnerships to gain traction, rather than building a brand and credibility from scratch.

At the time, financial coaches were gaining popularity and building communities on TikTok and other platforms. Their growing influence and reach to our target audience prompted us to reach out and continue research.

Note: Unlike advisors, coaches are non-fiduciary, and don’t provide advisory services or handle money. Instead, coaches provide education and guidance on personal finance basics.

Coach insights

Interviews with several full-time coaches and part-time educators revealed crucial insights:

Lack of visibility into results

Coaches often used webinars, PDFs, and spreadsheets to reach a larger audience. However, these tools fell short in communicating outcomes back to the coach. Additionally, coaches lacked time, skills, and resources to build a product to meet this need.

Balancing personalization with scale

One-on-one coaching was more personalized yet time-consuming and costly for both parties.

“[One-on-one coaching] is the most gratifying […] to have someone in real time tell me where they're blocked and help them through it. With my digital products or webinars, they'll be inspired, but I don't see the follow through or results.”

— "Fiscal Femme" Full-time coach and CEO

We saw a gap in the market: there was no dedicated tool for financial coaches to continuously engage with their audience, track progress, or see their community's financial health collectively.

End user insights

Interviews with eight women in a coach’s Slack community added detail around motivations, habits, and learning gaps.

Validation of mindful spending

Our discussions confirmed that mindful spending is a critical strategy for users, who used everything from handwritten journals to spreadsheets for managing finances.

"[My money journal] makes me actually stop and think about what I'm spending and remember that I absolutely do have a choice."

— "Fiscal Femme" Slack Community Member

Community impact

The sense of belonging and mutual support within these communities was profound. The connection fostered between financial coaches and their communities highlighted the strength of shared experiences and goals.

Clasp platform

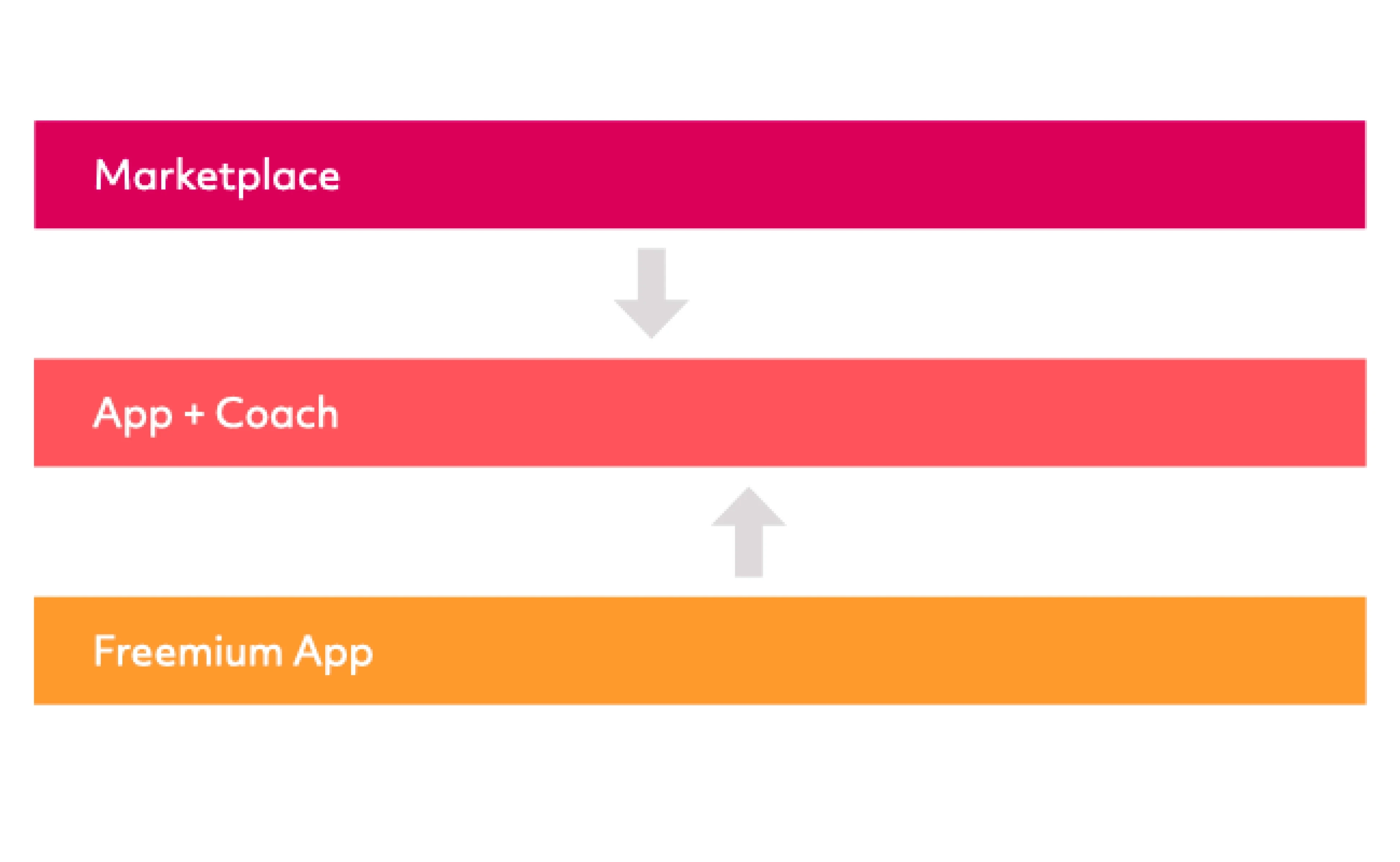

We applied insights by pivoting Clasp into a financial coaching platform with the following components:

Clasp Money Journal

The end user iOS app would remain free, with visual and UX refinements.Coaching Add-on

Coaching (messaging, advice) would be available as a paid premium option within the app.Acquisition Funnels

If a coaching proof of concept was successful, we would pilot a directory/marketplace outside of the app, for users to connect with a coach.

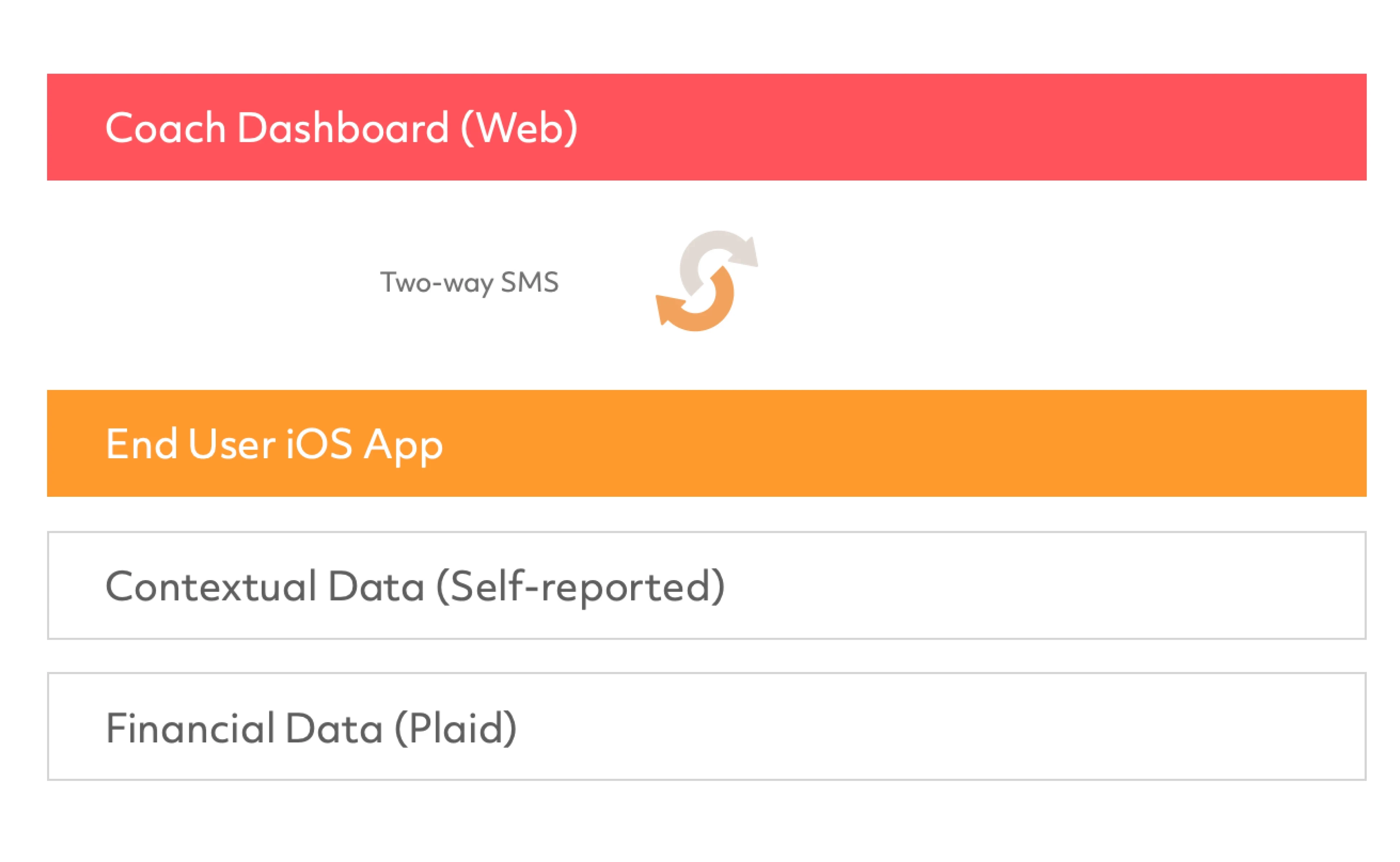

The proposed Clasp ecosystem.

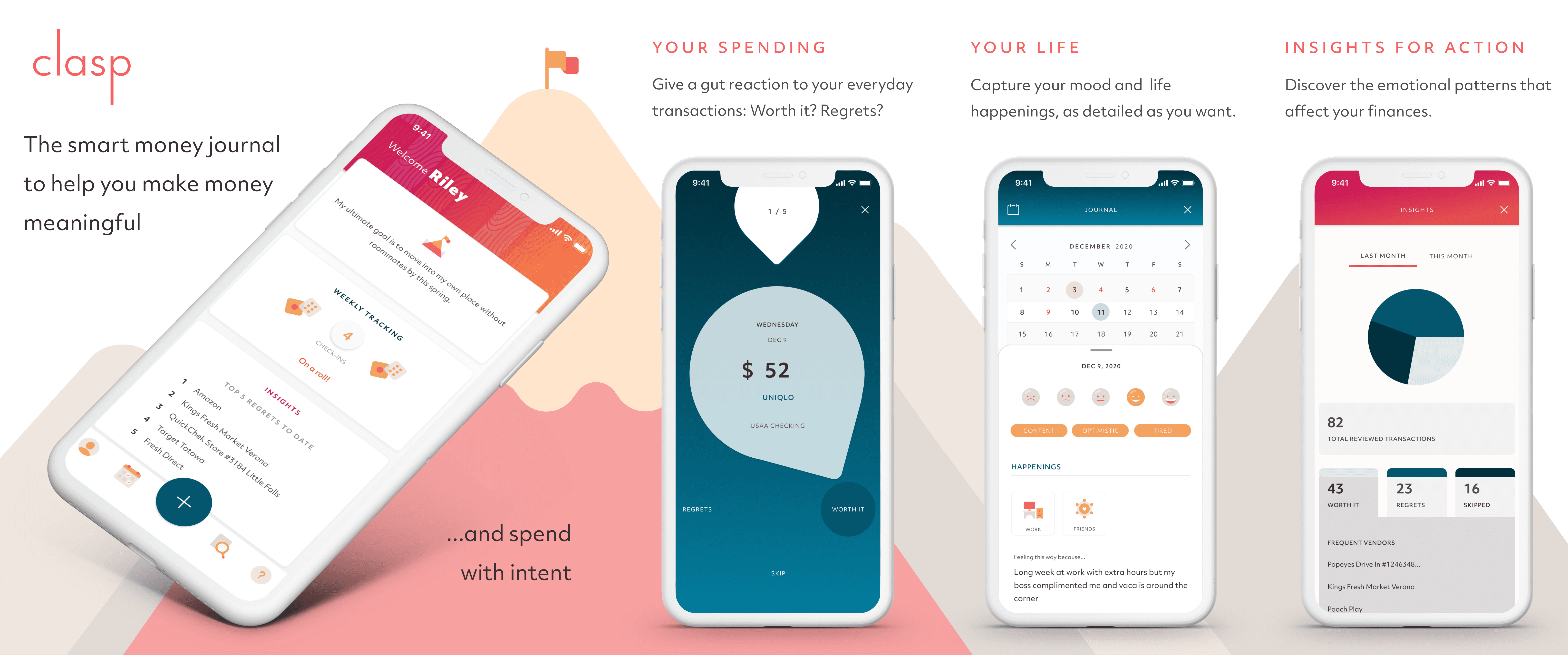

Money Journal

We tightened up the iOS app by focusing on a consistent journaling habit. Coaching would be tested as a separate proof of concept.

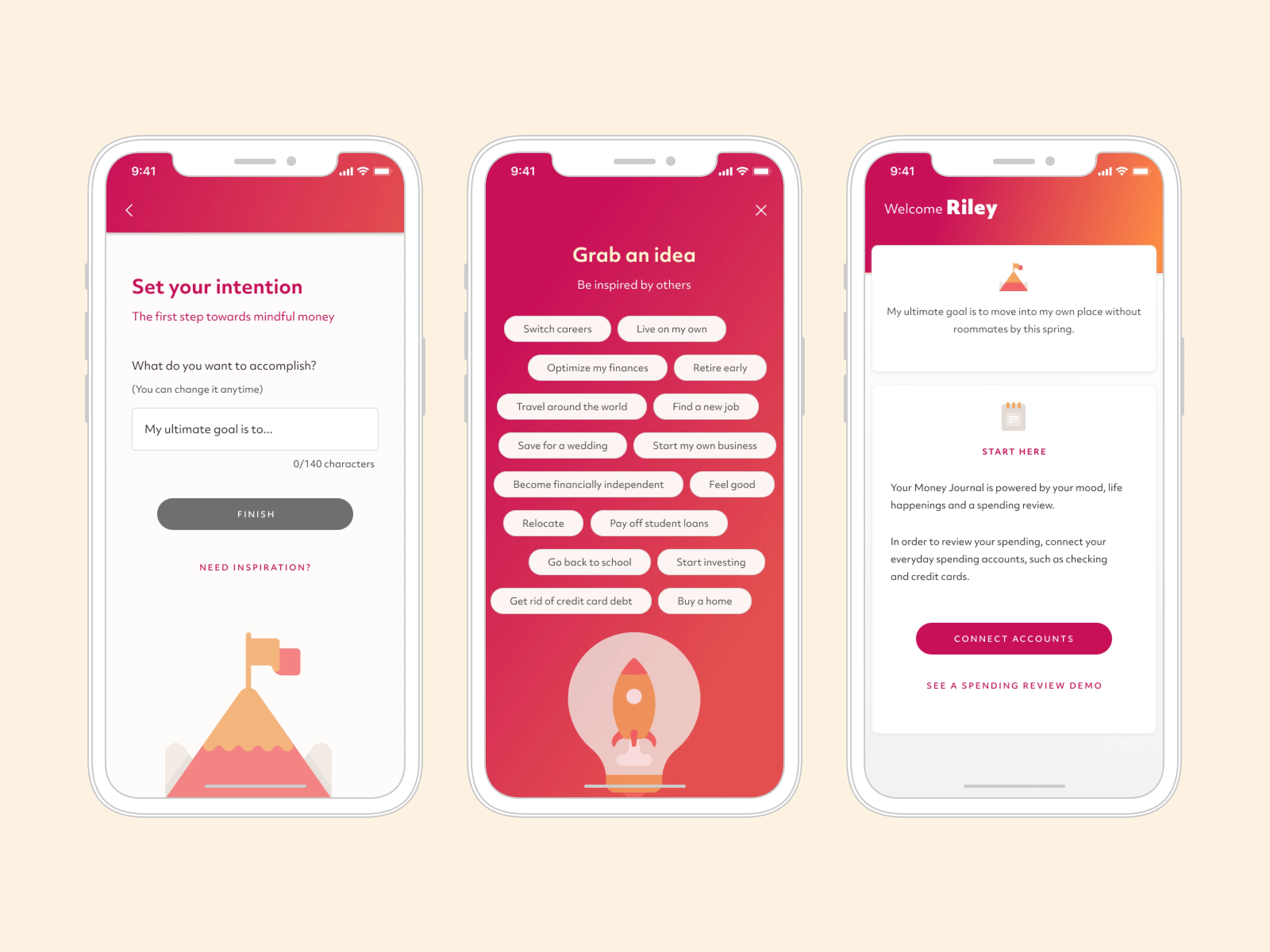

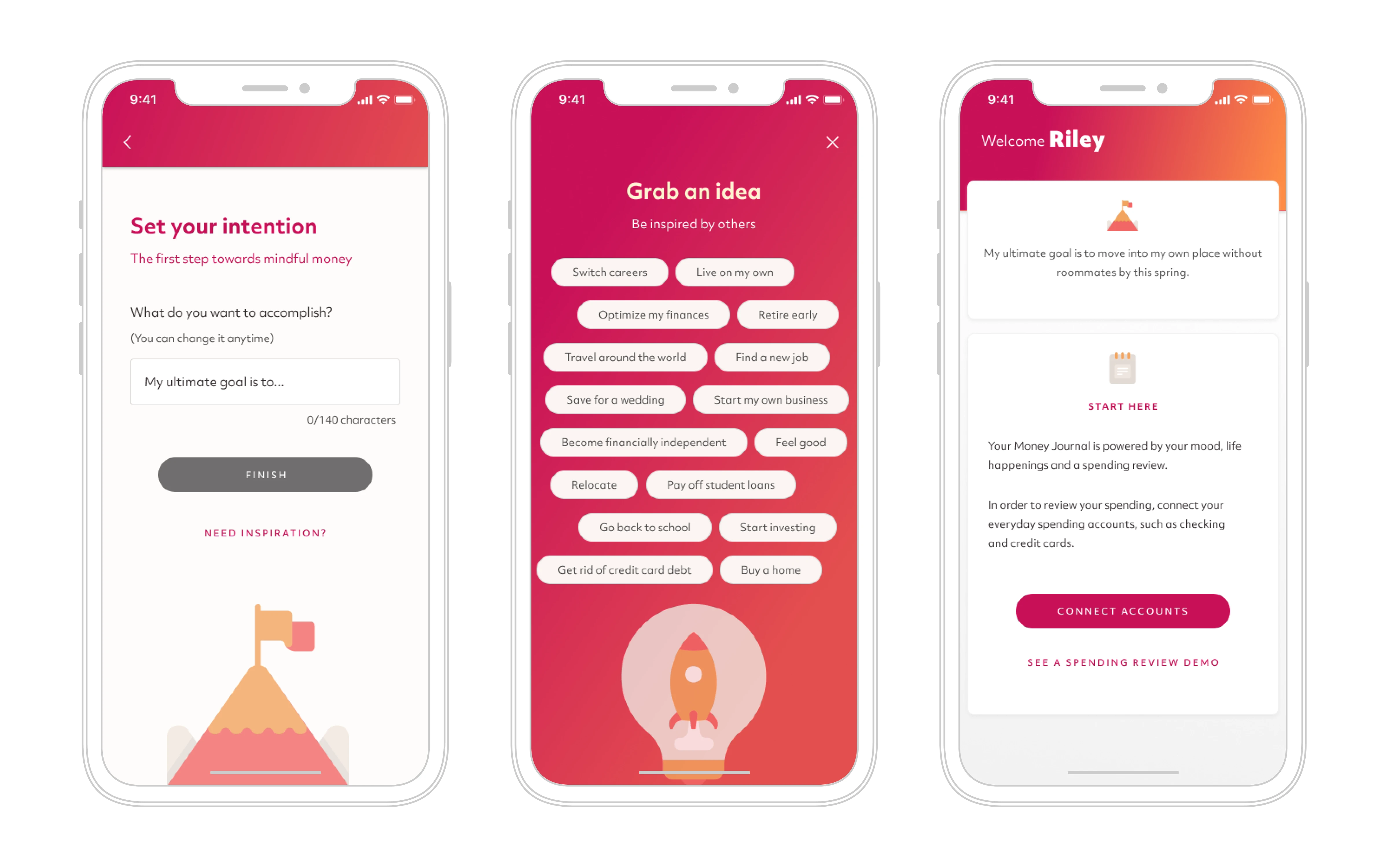

Purposeful onboarding

During onboarding, users set their intentions, linked their accounts, and completed their first check-in. The ideas for inspiration were based on what we had heard during user interviews.

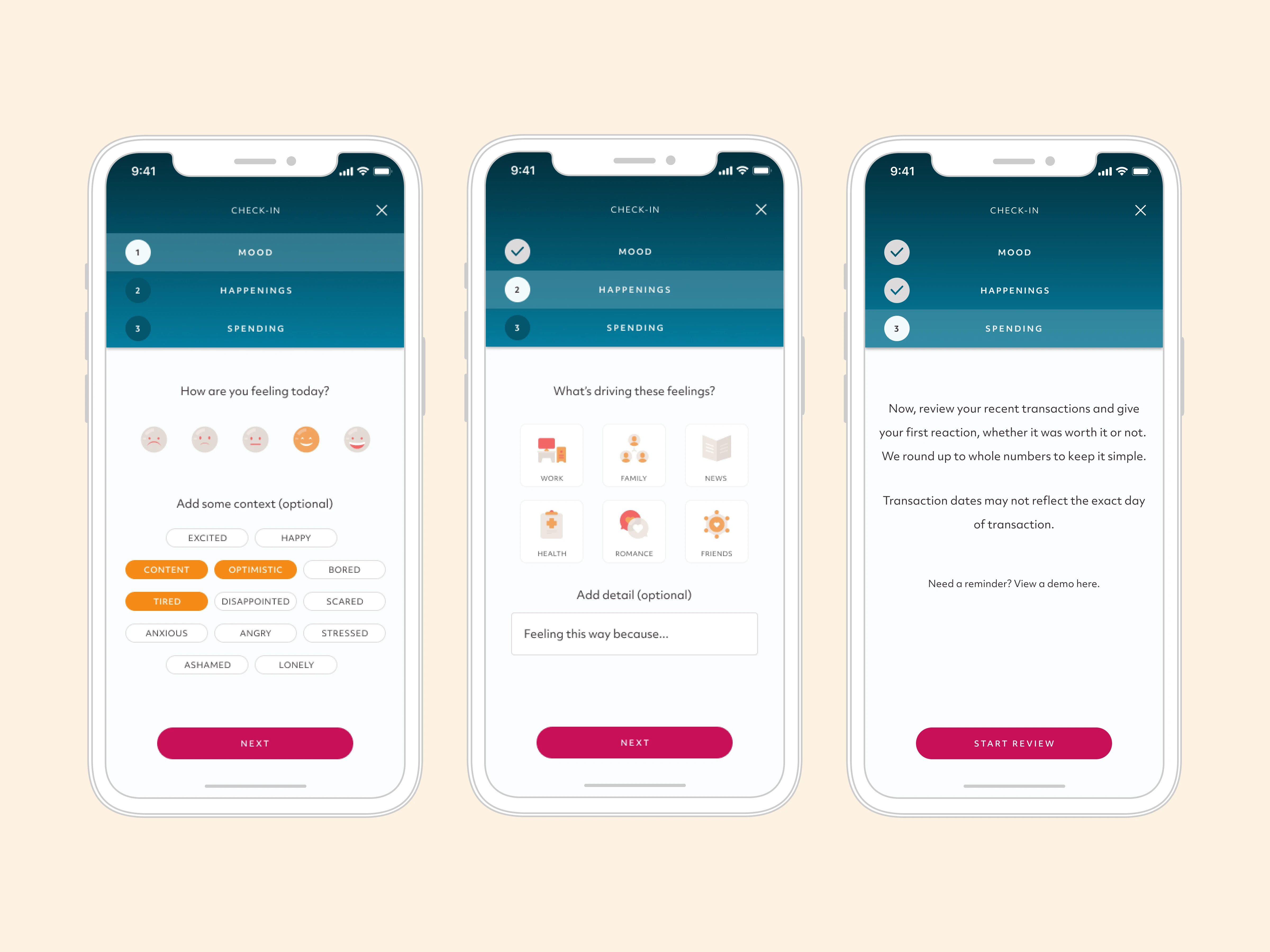

Three-step check-in

Check-ins started with mood and event logging, with optional emotional tags and detailed text entries. In the spending review, users gave a gut reaction to recent transactions as worthwhile, regrettable, or uncertain. Transactions were grouped in sets of five to minimize cognitive overload.

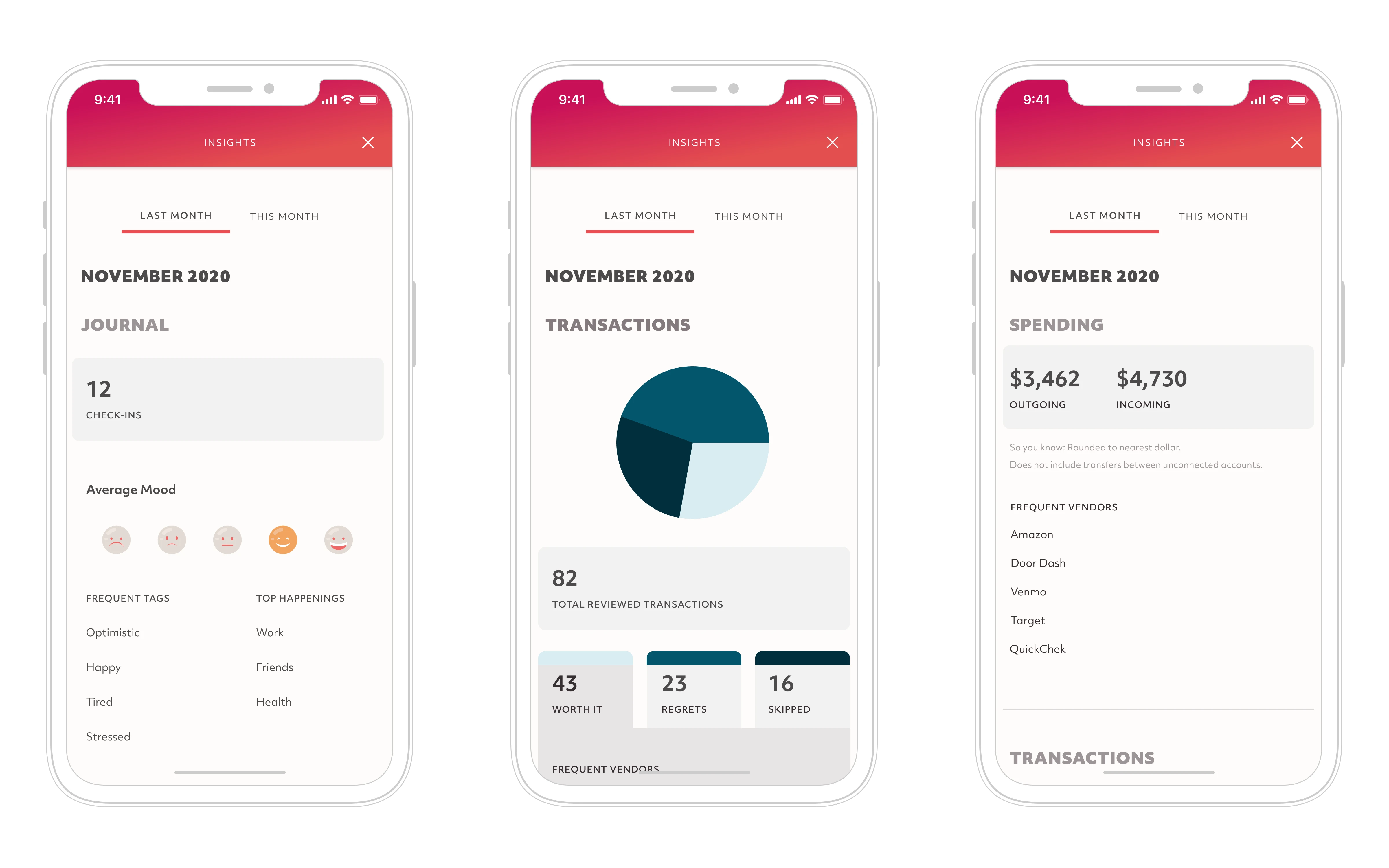

Insights

For a first pass, we kept insights simple, aggregating the most frequent responses. Eventually, we would add depth with data patterns.

Coaching

Proof of concept

We split development into two parallel tracks:

Freemium Money Journal app without coaching

Proof of concept coaching experience via TestFlight.

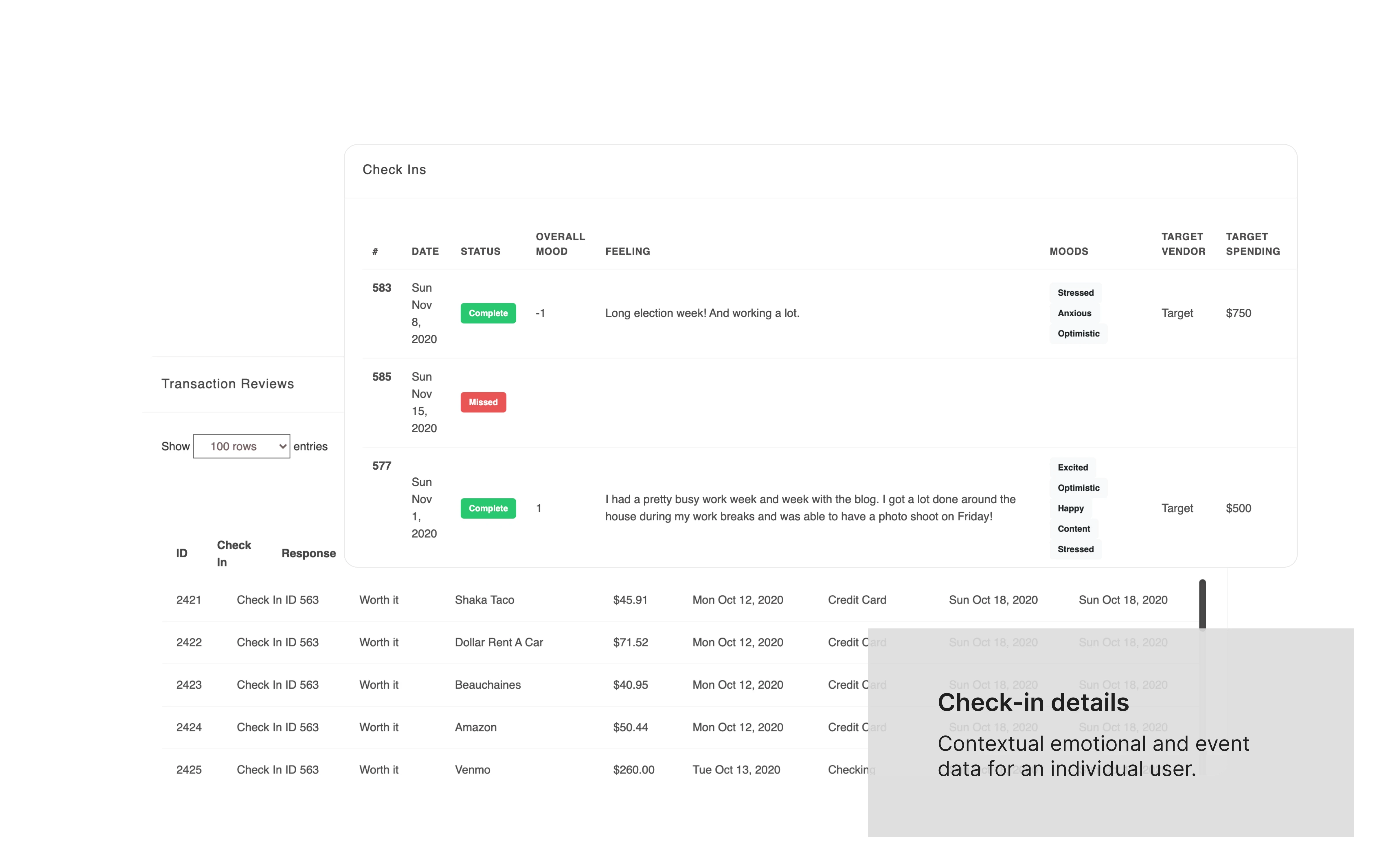

For the proof of concept we added additional coaching screens into the production app for a small user group to test. Additionally, we built a web-based coach dashboard with SMS capabilities via Twilio, and visibility into user transactions and journaling.

Proof of concept for in-app coaching.

Constraints

We didn’t want the freemium Money Journal to hold up the proof of concept, so we added coaching screens within the existing codebase on TestFlight. Not the prettiest nor the cleanest, but enabled us to move forward.

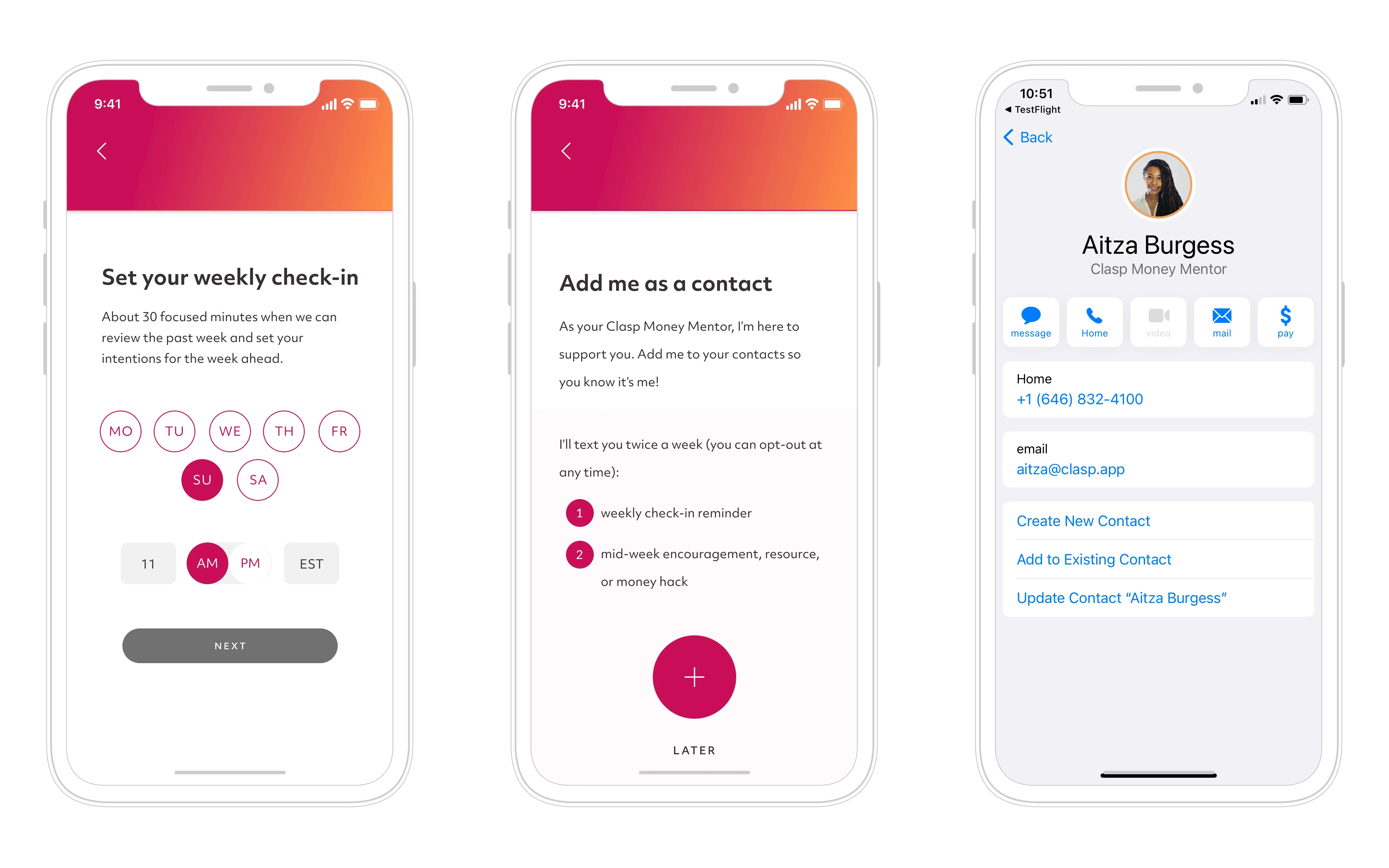

Additionally, our primary coach went on maternity leave and we didn't have time to cultivate a new relationship with another influencer. Aitza, our social media manager, had a background in finance counseling and stepped in as a interim coach. She leveraged her network to form a test group of eight, familiar with her, for a focused three-week test.

Onboarding

We introduced two new screens: one for scheduling weekly check-ins and another for adding the coach as a contact, so SMS messages would feel more personal.

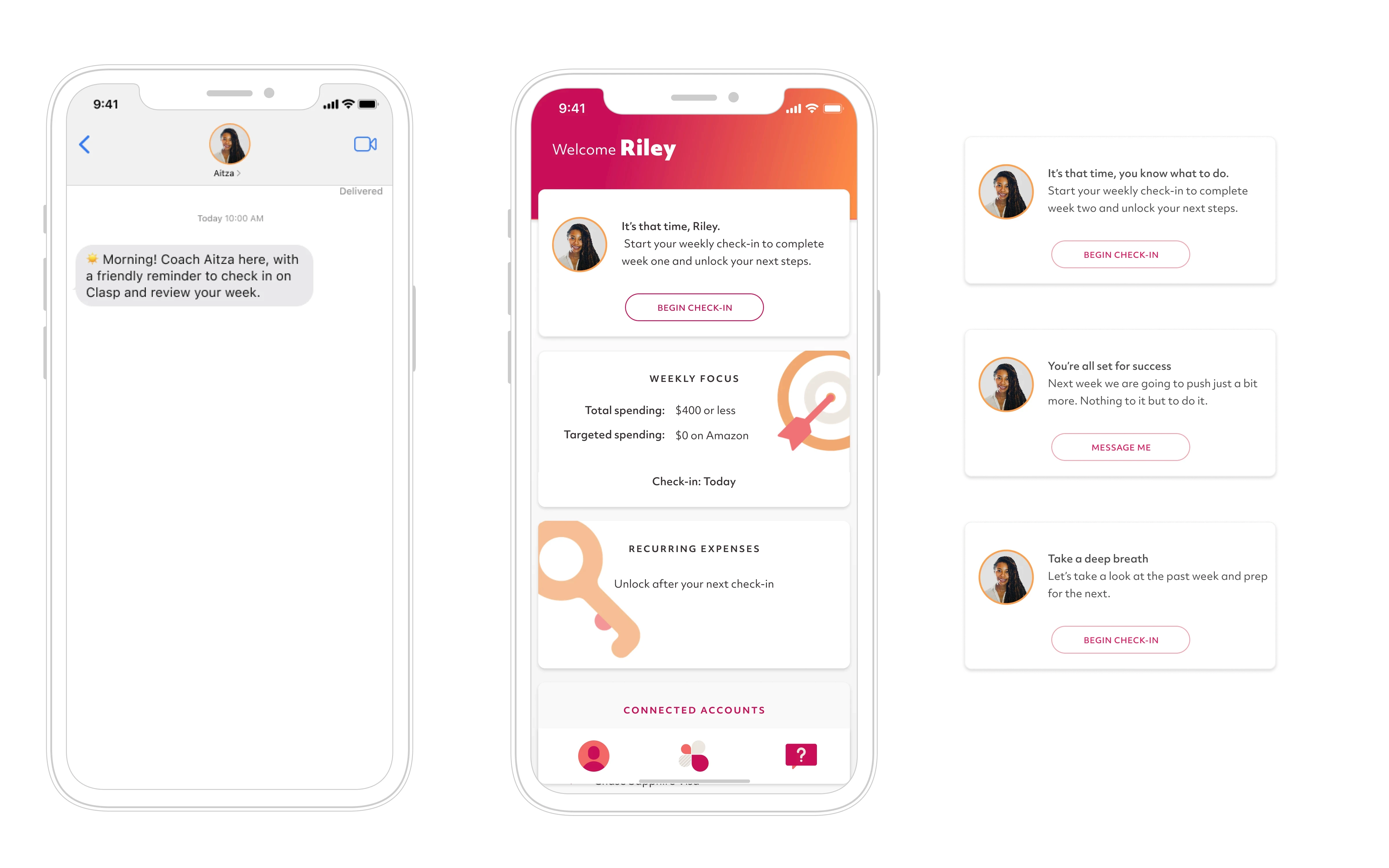

Weekly check-in/SMS

We integrated Twilio for SMS capabilities. The coach sent weekly SMS reminders to check-in, review transactions, and set weekly spending goals. The coach card on the home screen changed weekly, depending on user activities (options shown on right.)

Coach dashboard

A streamlined view into user financial behaviors and journal reflections in addition to composing, scheduling, and sending SMS. Future vision included the ability for a coach to see trends across their community, and for Clasp to flag users that needed help or congratulations.

User feedback

End user feedback was largely positive, in fact some users wanted more interactive sessions. Some users thought the weekly check-in would be a live session with Aitza. Additionally, recurring expenses had accuracy issues. The personalized SMS was a hugely popular.

On the coach side, setting expectations for availability was noted. My co-founder and I also recognized the need for vetting across all coaches to ensure quality.

User Acquisition

Funnels

While developing the Clasp Money Journal, we created additional acquisition funnels:

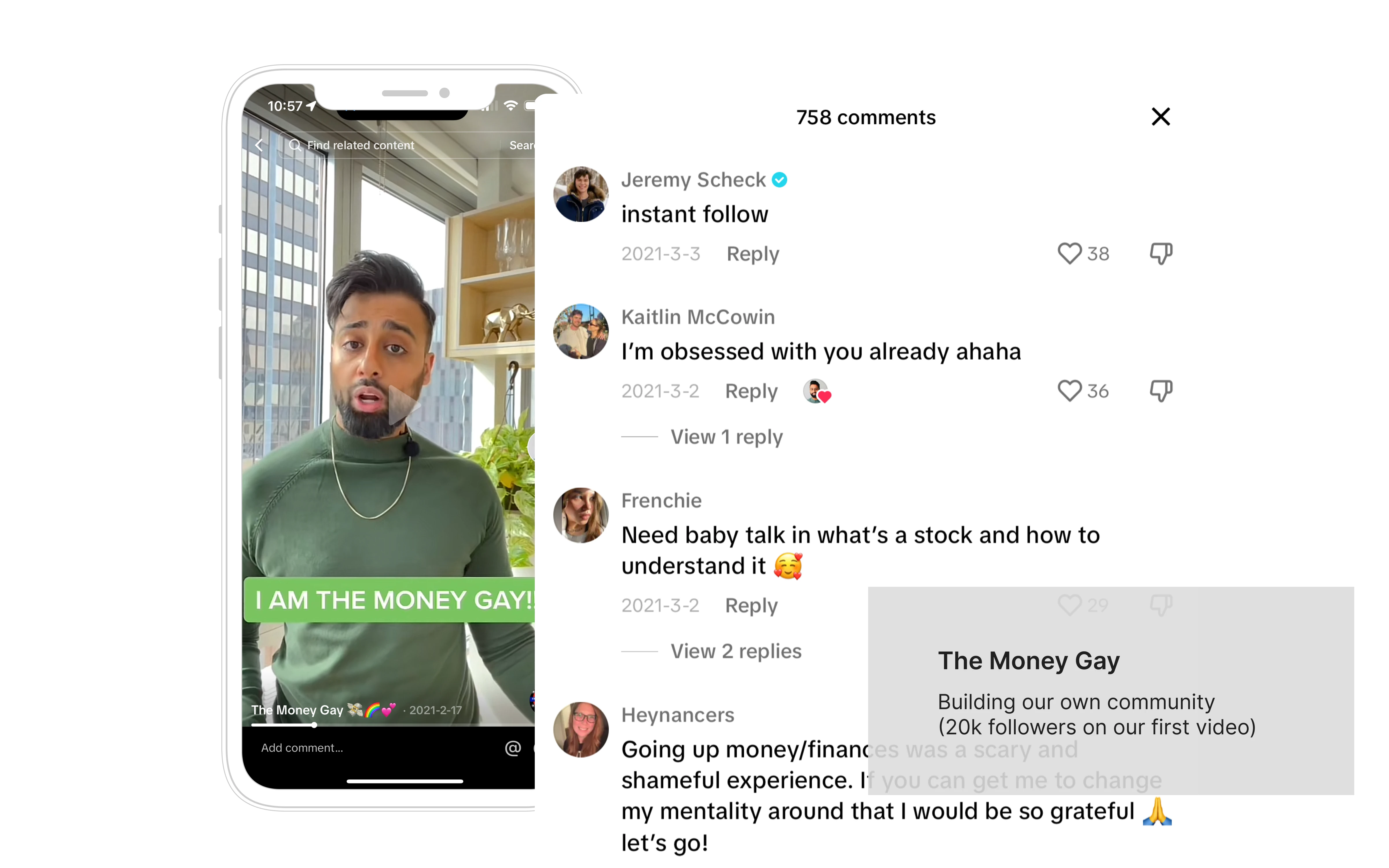

The Money Gay on TikTok

Created an influencer (my co-founder) to build our own community and engage our target audience. Our first video resulted in 20k followers in one weekend.Money Mindset Blueprint Course

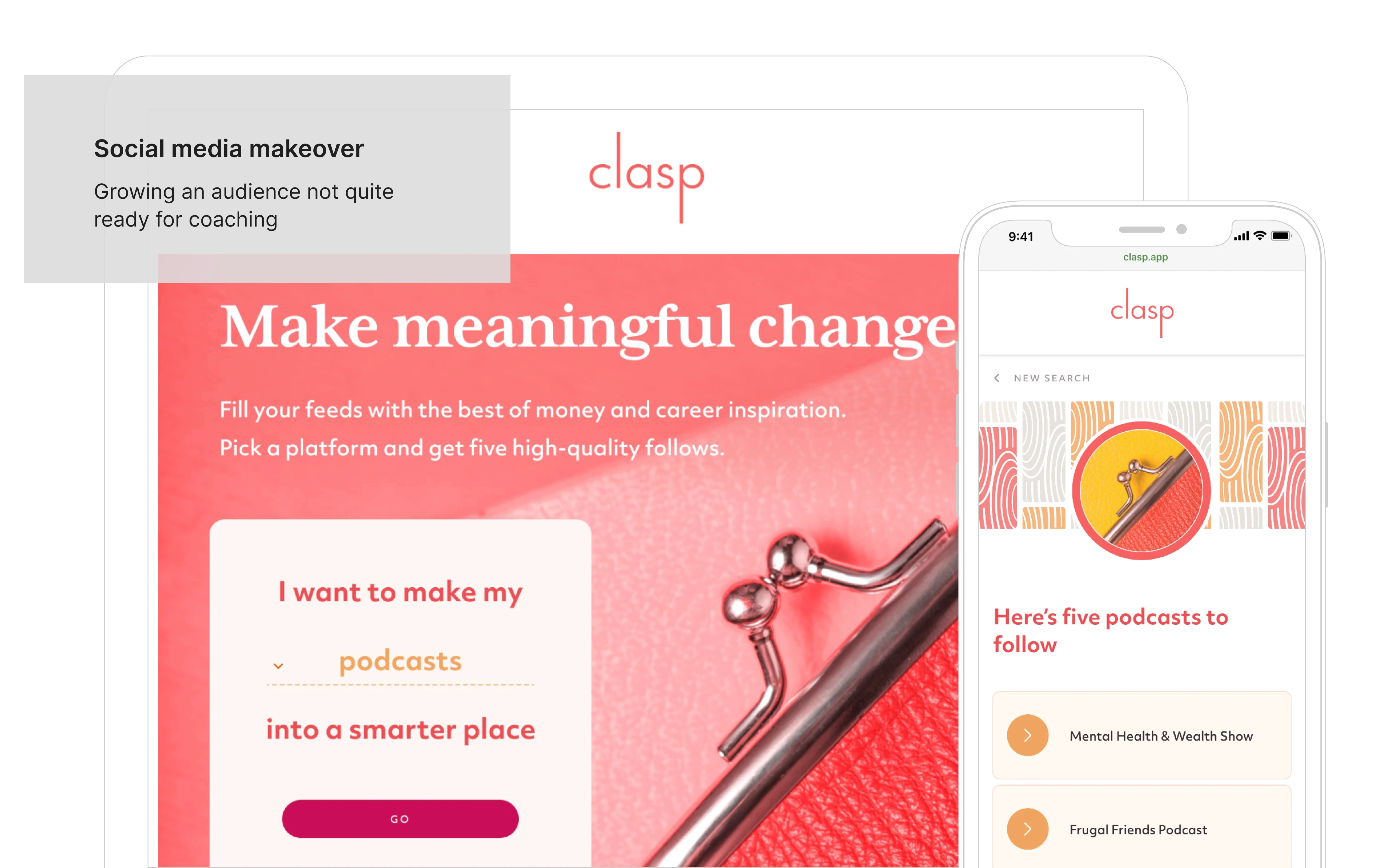

Introduced a course on Teachable to complement the app, focusing on emotional reframing.Social Media Makeover (unlaunched)

Promoted a campaign for a healthier financial perspective on social feeds, aiming to attract a wider audience.Coach Marketplace (unlaunched)

Began building a space for users to discover financial coaches.

Navigating the unexpected

Just as we launched—the Clasp Money Journal, the Teachable course, and the full suite of resources —my co-founder bowed out for personal reasons. This wasn’t how we envisioned things ending, but it's a reality many startups face.

This experience taught me plenty about the startup journey: resilience, the need for clear backup plans, and the importance of understanding between partners. Every startup story has its ups and downs, and it's all part of a bigger learning curve.

Key learnings

Business

Design the business first

We would have been better served by establishing a clear monetization strategy early on. Getting users on board and engaged is fantastic, but the real puzzle was figuring out revenue, especially with coaches. The lesson learned is clear: understand how your startup will generate revenue before scaling the user base.

Product

Build a community: have a plan

Leveraging influencers and their communities proved crucial for gaining traction. However, building these relationships was time-consuming and felt like a bit of a dance. (Fun fact: in the process of networking, we later discovered a major influencer copied parts of our money journal.)

Creating our own community through TikTok eliminated our dependency on influencers for testing concepts. However, when we suddenly attracted an audience with The Money Gay, iOS app development was well underway. We needed a more defined approach for engaging our TikTok audience. Success lies not just in capturing interest but in sustaining and deepening engagement.

Business

Focus on smart growth over scale

The allure of scaling can be tempting for any startup, but our journey taught us the value of smart, incremental growth. Many of our solutions were more complex than necessary. The key takeaway is to aim for progress towards the next immediate goal, rather than overreaching towards a distant future.